The Mathematics of Memecoins

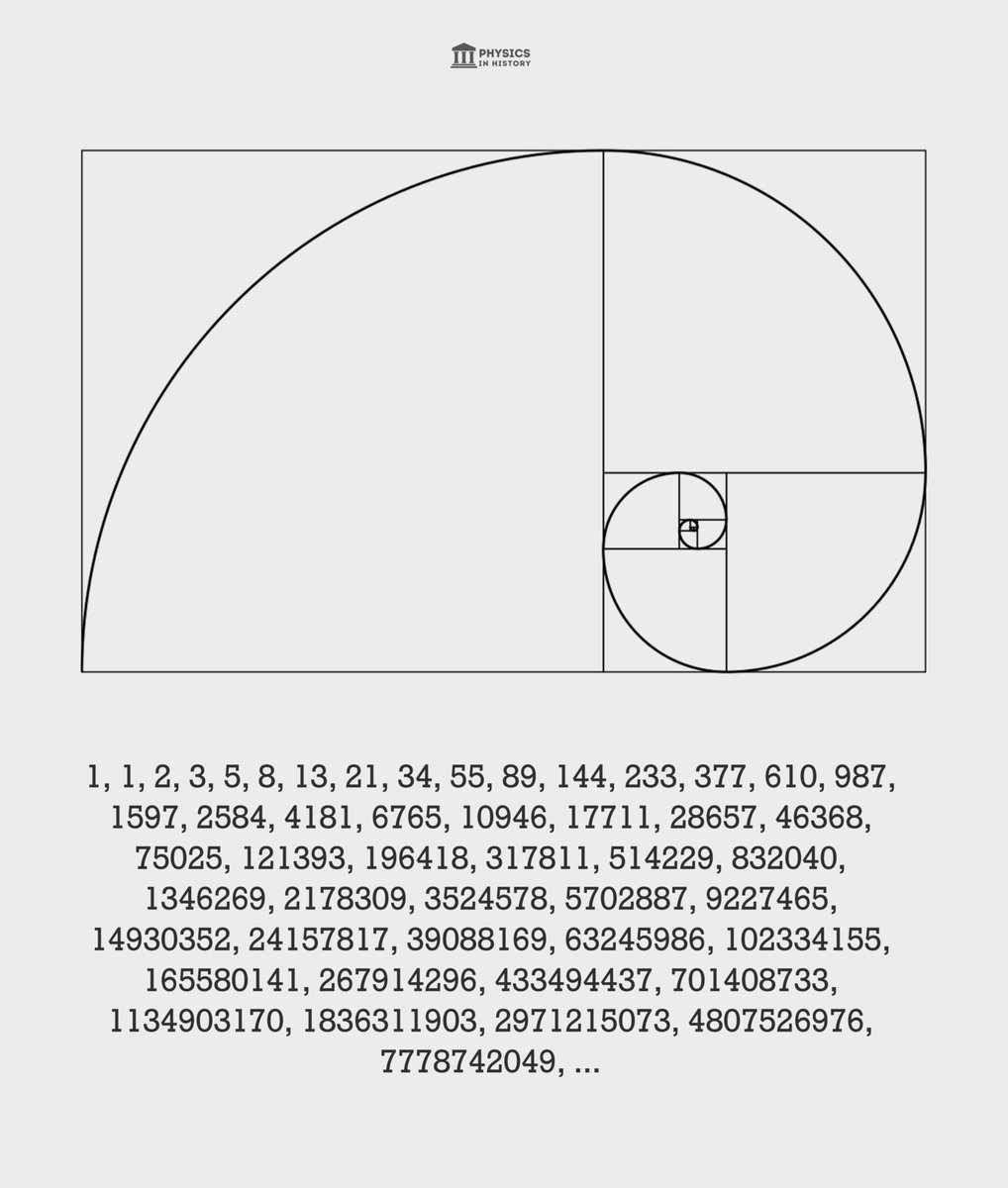

The Sequence that Governs the Crypto Universe

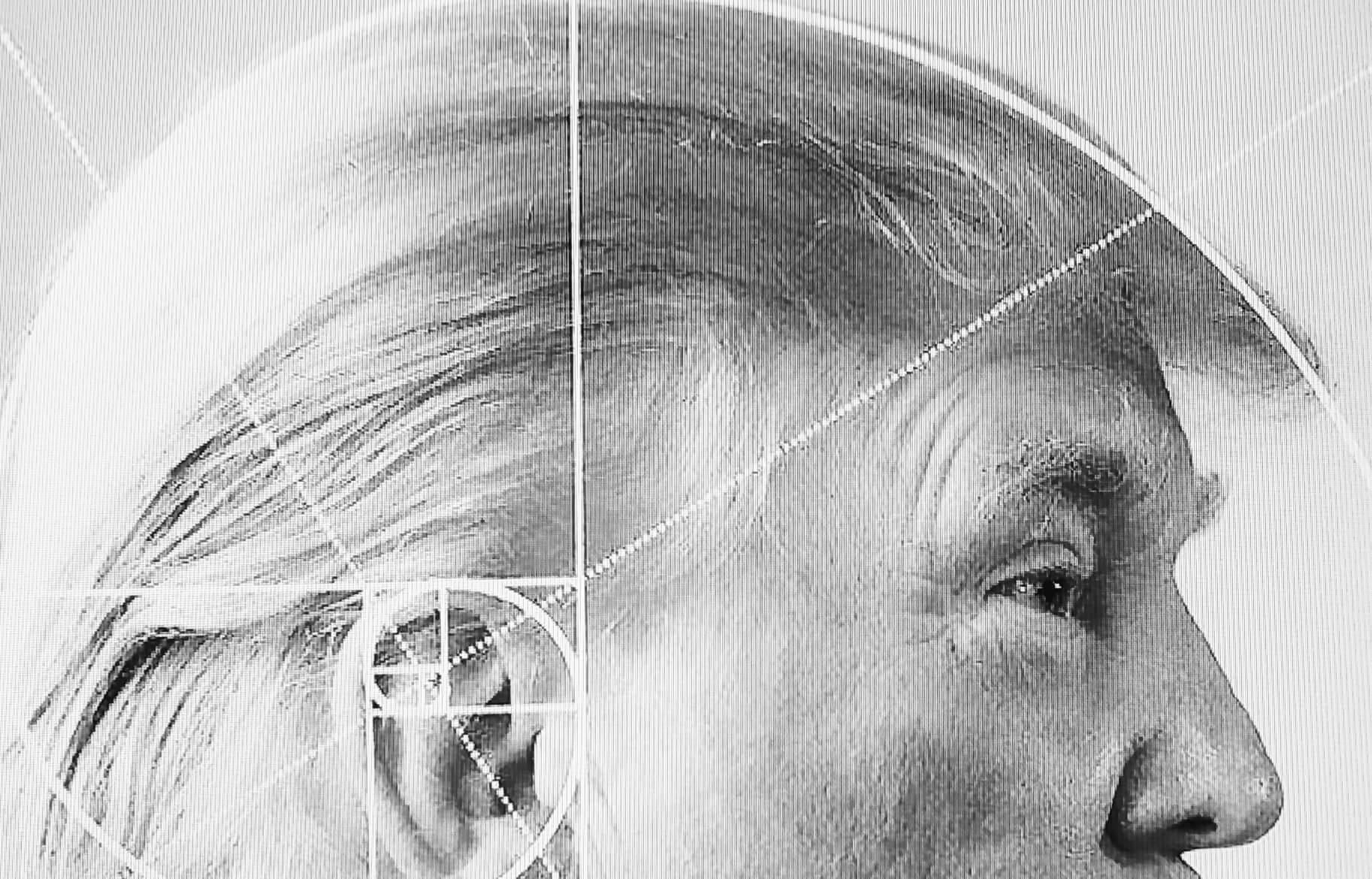

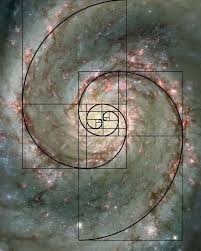

What if the same logic that governs flower petals, galaxy spirals, and ocean waves also ruled the memecoin market? Discover how the Fibonacci sequence reveals hidden patterns in the apparent chaos of cryptocurrencies.

Discover